702-252-7100

702-252-7100

If you've never owned a home before... GET ON BOARD! It's easier than you think and you'll have long term financial benefits as well as a place of your own! Quit paying the payments for your landlord... contact us TODAY!

Renting vs. Buying

(an overview)

Three key reasons why people choose to buy a home vs. renting a home

1. Profit/Tax Benefits

2. Stability/Predictability

3. Freedom (to do what you want to your home)

1. Profit/Tax Benefits

2. Stability/Predictability

3. Freedom (to do what you want to your home)

Three common misconceptions of people who have never owned a home

1. It's not worth it (not enough profit to justify the risk)

2. "My credit is not good enough"

3. At least 20% down payment is needed

1. It's not worth it (not enough profit to justify the risk)

2. "My credit is not good enough"

3. At least 20% down payment is needed

Profit from Government Benefits:

The U.S. Government WANTS you to own a home and rewards you financially for being a homeowner.

1. It allows you do deduct mortgage Interest

2. It offers reduced rate loans and reduced down payments

3. It also allows you to have up to $500,000 profit tax free. (see IRS rules on this here)

https://www.ftc.gov/faq/consumer-protection/get-my-free-credit-report

The U.S. Government WANTS you to own a home and rewards you financially for being a homeowner.

1. It allows you do deduct mortgage Interest

2. It offers reduced rate loans and reduced down payments

3. It also allows you to have up to $500,000 profit tax free. (see IRS rules on this here)

https://www.ftc.gov/faq/consumer-protection/get-my-free-credit-report

Profit from equity building (paying down a mortgage and getting appreciation):

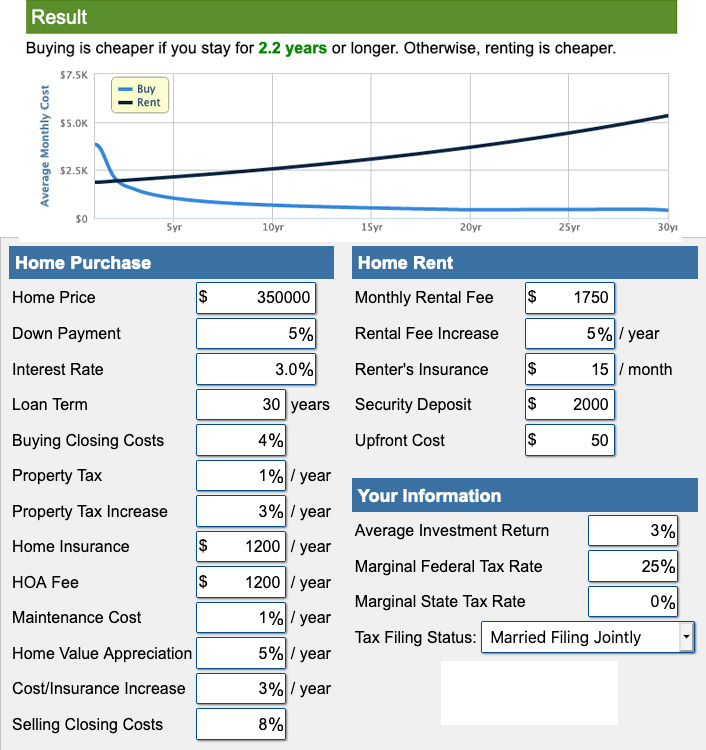

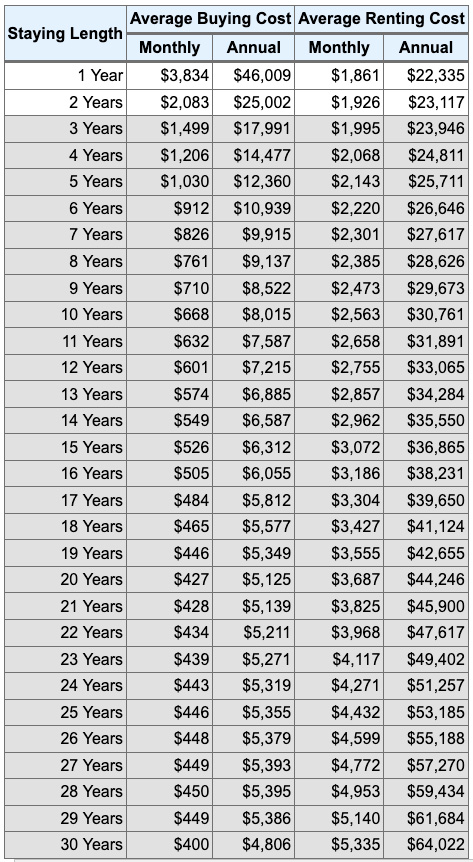

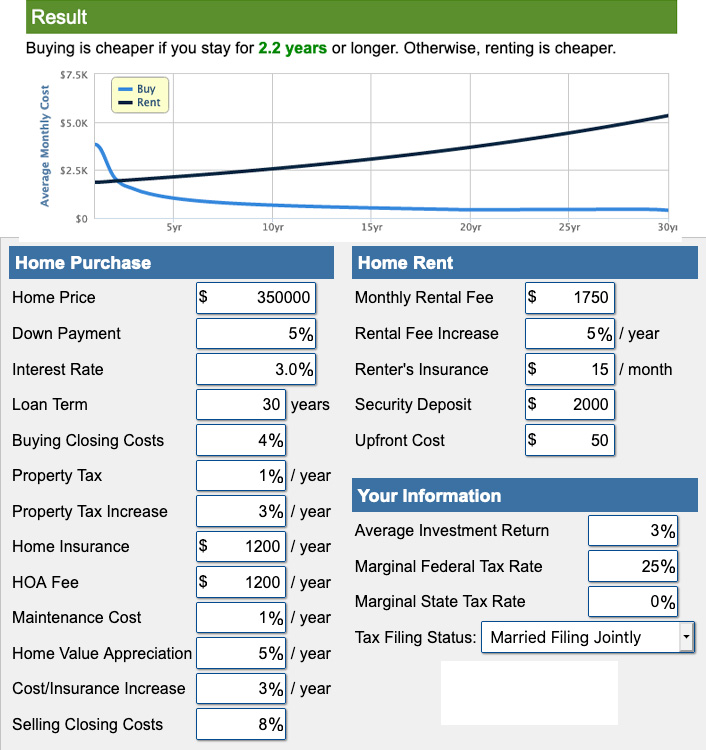

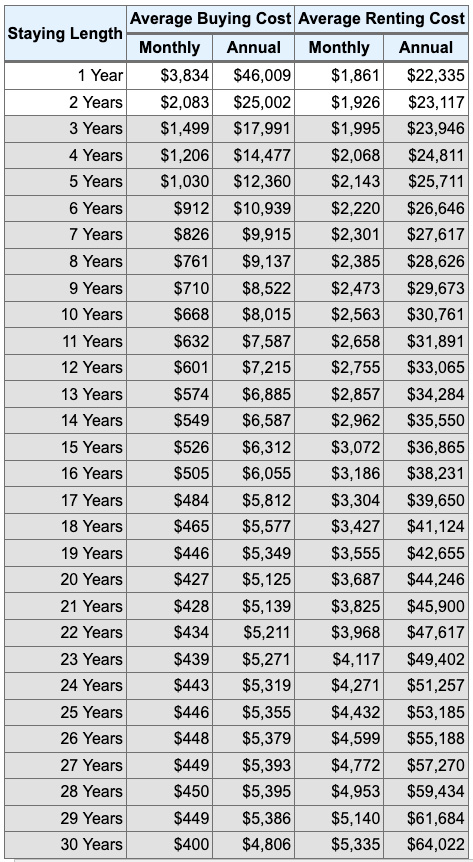

IF, instead of renting a home or apartment for $1750/month, you buy a $350K home instead, in 5 years you could be $50,000 ahead instead of just fighting to get your $1500 deposit back!

(click on the graph below to enlarge)

(click here to go to the calculator on REALTOR.org and make your own calculations)

IF, instead of renting a home or apartment for $1750/month, you buy a $350K home instead, in 5 years you could be $50,000 ahead instead of just fighting to get your $1500 deposit back!

(click on the graph below to enlarge)

(click here to go to the calculator on REALTOR.org and make your own calculations)

First thing is to find out your credit score. You're entitled to one free report each year from each of the three main reporting agencies:

Experian

Transunion

Equifax

Click here to start the process of getting your credit reports

Let me first say here that there are alternative methods of financing for those with a credit score below 580. In fact, once you are looking at alternative financing methods, credit score can be removed from the process all together.

Once you find out your credit score (usually somewhere between 300 and 850), you can take steps to secure a mortgage if it is a good enough score (for Conventional financing you need a minimum score of 620 in most cases and for FHA loans the minimum is 580)

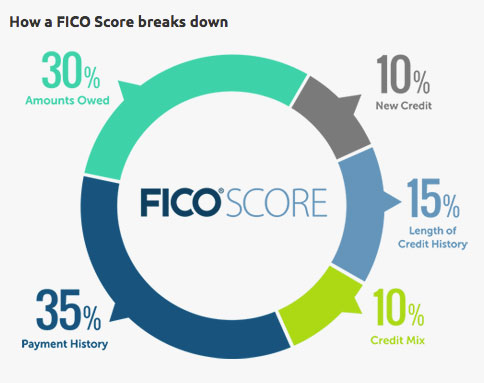

According to MYFICO.com, these are the things that effect your credit score and how much they do. If your credit score isn't what you want it to be, contact me and I can help you work on improving it.

Experian

Transunion

Equifax

Click here to start the process of getting your credit reports

Let me first say here that there are alternative methods of financing for those with a credit score below 580. In fact, once you are looking at alternative financing methods, credit score can be removed from the process all together.

Once you find out your credit score (usually somewhere between 300 and 850), you can take steps to secure a mortgage if it is a good enough score (for Conventional financing you need a minimum score of 620 in most cases and for FHA loans the minimum is 580)

According to MYFICO.com, these are the things that effect your credit score and how much they do. If your credit score isn't what you want it to be, contact me and I can help you work on improving it.

Once you know your credit score, you can research the different loan programs available to you. The better your credit score is, the better chance you have of getting low down payment loan options.

For Conventional financing backed by Freddie Mac or Fannie Mae, you need a minimum score of 620 and for FHA loans the minimum is 580

Conventional loans have down payments as low as 5% and FHA as low as 3%.

In addition, there are programs out there offering down payment assistance depending on your situation. Contact us to learn more!

For Conventional financing backed by Freddie Mac or Fannie Mae, you need a minimum score of 620 and for FHA loans the minimum is 580

Conventional loans have down payments as low as 5% and FHA as low as 3%.

In addition, there are programs out there offering down payment assistance depending on your situation. Contact us to learn more!

Learn more!!

No obligation...